- Home

- All updates

- EDGE Insights

- Industries

- Company Search

- My Watchlists (Beta)

EDGE Insights

Filter

EDGE Insights

GenAI ecosystem (Q4 2023): Product features and model capabilities evolve

Work

Jan 11, 2024

Older updates:

EDGE Insights

Notarize: The online remote notarization service

Residential PropTech

Dec 7, 2024

EDGE Insights

Ramp: The corporate card and expense management company

Security

Dec 7, 2024

EDGE Insights

Betterment: The investment app with automated investing, financial planning, and cash accounts

Retail Trading Infrastructure

Dec 6, 2024

EDGE Insights

NVIDIA Q3 FY2025 recap

Information Technology

Nov 26, 2024

EDGE Insights

RegTech

Capital Markets Tech

Nov 25, 2024

EDGE Insights

Ripple: The blockchain-based digital payment company

Cryptocurrencies

Nov 17, 2024

EDGE Insights

H2O.ai: The open-source AutoML platform

Machine Learning Infrastructure

Nov 17, 2024

EDGE Insights

PsiQuantum: A pioneer in advancing quantum computing hardware development

Quantum Computing

Nov 17, 2024

EDGE Insights

State of tech in Financial Services: How AI, blockchain, and biometrics are forging the future

Financial Services

Nov 13, 2024

EDGE Insights

Valimail: The email authentication and security solutions provider

Machine Learning Infrastructure

Nov 12, 2024

By Nathasha Peiris · Jan 11, 2024

GenAI ecosystem (Q4 2023): Product features and model capabilities evolve

Key takeaways

Regulations

- EU legislators reached a preliminary political consensus to sign the Artificial Intelligence Act, moving closer to passing a comprehensive law to regulate AI.

- In the US, the President signed an executive order that requires developers to safety-test new models.

- China continued to strengthen its regulatory framework, proposing more controls on training data and models.

Funding

- During Q4 2023, companies in the GenAI space raised USD 3.1 billion in total, recording a decline of 9% compared with Q3 (USD 3.4 billion) and 18% compared with Q2 (USD 3.7 billion).

- Foundation Models startups dominated, with USD 2 billion raised during the quarter, in line with Q3 2023. Google’s investment of USD 500 million in Anthropic, German large language model (LLM) developer Aleph Alpha raising USD 500 million, and Mistral AI’s USD 415 million funding round contributed over 70% of total funds raised.

- GenAI Infrastructure: 25 disruptors in the space raised USD 550 million, a 50.2% decline from the previous quarter. Lightmatter recorded the most funding, with USD 155 million raised.

- GenAI Applications: 40 disruptors in the space raised USD 577 million, recording an increase of 67.3% compared with Q3 2023. Chatbot developer xAI secured USD 135 million, marking the highest funding secured by a disruptor throughout the quarter.

Product updates

- Foundation Models: Several major disruptors introduced the next iterations of their existing models, including OpenAI’s “GPT-4 Turbo” model, Anthropic’s Claude 2.1 model, and Inflection AI’s Inflection-2 model. Google also launched Google’s Gemini, claimed to be its largest and most advanced AI model to date.

- GenAI Infrastructure: Several incumbents, including Amazon, AMD, and Qualcomm, as well as disruptors like Kinara and Preferred Networks, launched new AI chips. Microsoft and Google reported developing their own chips to reduce dependency on third-party chip providers. Companies in the space also launched tools to develop custom foundation models (Datasaur, FedML, Hugging Face, and Outerbounds) and tools to simplify application development (Kyndryl, Landing AI, Lightning AI, and OctoML).

- GenAI Applications: Two notable OpenAI competitors (for ChatGPT) emerged: xAI’s Grok and Reka’s Yasa-1. OpenAI introduced several updates to its chatbot, including the re-launch of the web browsing feature, a beta feature for Plus members to upload and work with files, and a new platform (not launched yet) allowing users to create custom versions of chatbots. Disruptors also introduced new features to enhance existing products during the quarter. Google launched several updates for its chatbot, Bard, headlined by the introduction of its new model Gemini Pro. Microsoft made substantial improvements to its chatbot by integrating OpenAI's latest models, such as GPT-4 Turbo and an updated DALL-E 3 model, and introduced several other new features (such as launching Copilot for Azure, Copilot for Service, and Copilot Studio, expanding Copilot, and rolling out a dedicated Copilot app).

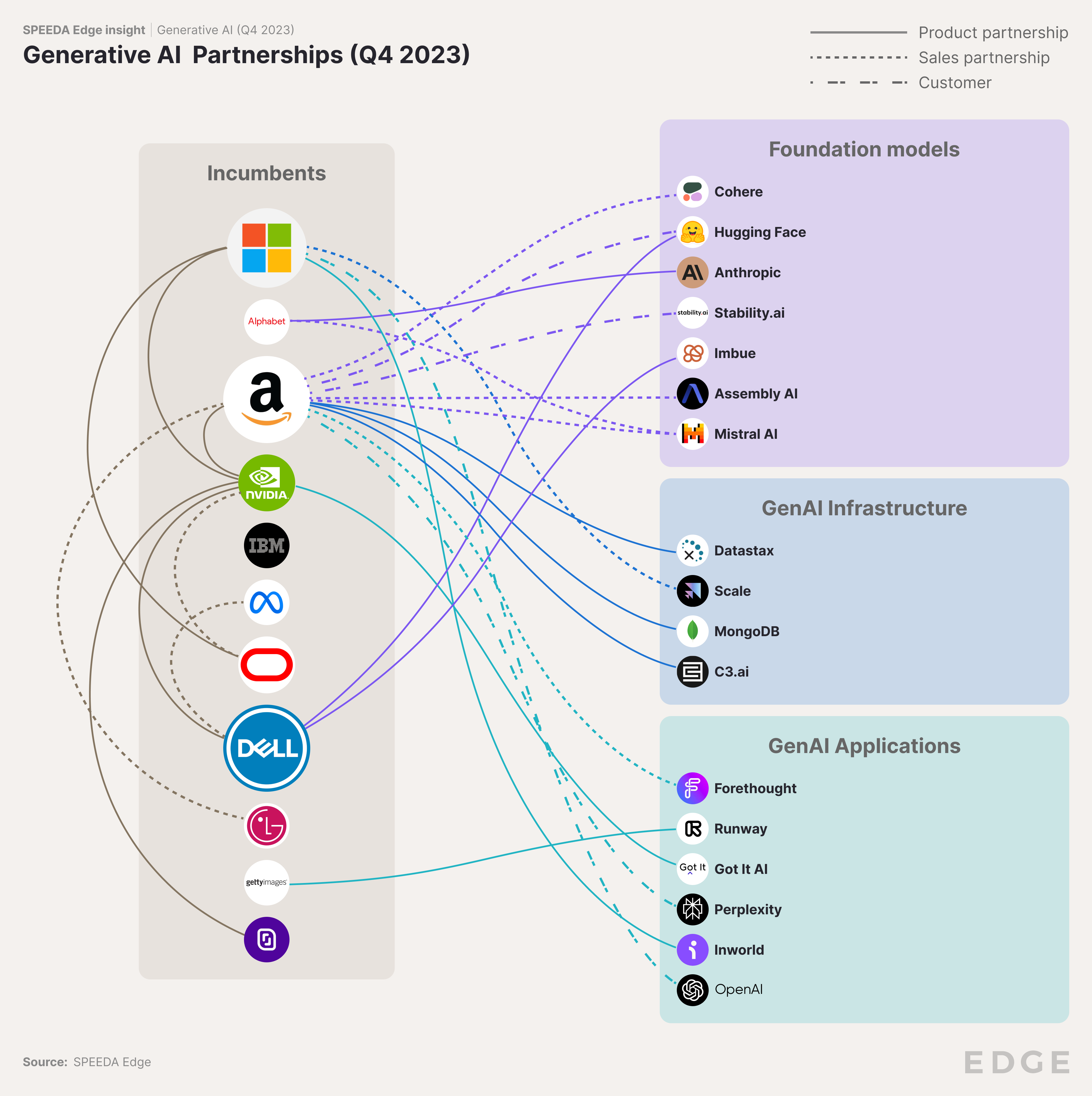

Partnerships

- Foundation Models: Various disruptors like OpenAI, Assembly AI, Cohere, and Mistral AI joined forces with Cloud providers, aiming to enhance the accessibility of their models. Both disruptors and established players showed keen interest in on-premise deployment, demonstrated by Hugging Face and Meta's collaboration with Dell.

- GenAI Infrastructure: Partnerships by established players were mostly with cloud infrastructure providers such as Microsoft Azure, Google Cloud, and Amazon Bedrock to leverage their cloud-based infrastructure and the foundation models available on them. Amazon entered several product collaborations to offer integrated infrastructure solutions.

- GenAI Applications: Video creation platform Runway and Getty Images partnered to develop a model for generating video content, and Xbox, Microsoft's video gaming brand, partnered with character developer platform Inworld AI to enhance creative storytelling and game design. The majority of the partnerships recorded by incumbents were with customers. Product collaborations were reported by Amazon and Microsoft partnering with GenAI infrastructure providers MongoDB (to optimize Amazon CodeWhisperer for enhanced application development) and Oracle (to enhance Bing's AI search with cloud infrastructure), respectively.

Outlook

- Adoption of GenAI products likely to increase: In 2023, GenAI tools, such as ChatGPT, surged into public awareness. Moving into 2024, as companies identify potential productivity improvements, there's anticipation of accelerated spending on enterprise GenAI products across various sectors.

- Rivalry among both incumbents and disruptors likely to intensify: Companies are continuously improving their models to be able to outrank others in model benchmarks. While Google claims its latest Gemini model outperforms OpenAI’s GPT-3.5 among several benchmarks, signaling a significant upgrade for its chatbot, Bard Advanced is expected to arrive in 2024, bringing advanced capabilities, including multimodal support for text, images, audio, and code. Additionally, Speculation has emerged around Meta's next AI move, potentially Llama 3, claimed to be comparable with OpenAI's GPT-4, which might launch in early 2024.

- On-device processing, especially on smartphones, appears to hold significant potential: During Q4 2023, several companies launched solutions targeting on-device processing (on mobile phones), including chipmakers like Qualcomm and MediaTek. Rumors emerged that Apple too was exploring the possibility of storing LLMs on flash storage to bring the technology to mobile phones. Several companies also launched models that can run on mobile devices, including Samsung and Stability AI. Due to the benefits of on-device processing (e.g., enhanced privacy as user data stays on the device, reduced risks of external breaches, and a more personalized user experience), it is likely that companies will allocate more resources to this area.

Regulations: EU marks milestone reaching preliminary political consensus to sign Artificial Intelligence Act

Analyst take: This quarter marked a milestone for EU regulators, who reached an agreement on the Artificial Intelligence Act. The European Parliament still needs to vote on it, but this is only a formality, according to an Italian lawmaker involved in the negotiations. Unlike the EU, the US is still at the initial discussion state in terms of safeguards for AI. This quarter, the Biden Administration took action by issuing an executive order signed by the President in line with the voluntary pledges made by tech companies on safe, secure, and trustworthy AI. China, which implemented regulations in the previous quarter, aims to advance its regulatory stance by striking a balance between harnessing the benefits of AI and mitigating the risks. Interestingly, the Beijing Internet Court's decision on granting copyright to AI-generated images could have far-reaching implications on the use of AI technology.

- EU reaches milestone agreement on AI regulations: In December, EU regulators managed to resolve major disagreements on contentious issues, including GenAI. As a result, they reached a preliminary political consensus to sign the Artificial Intelligence Act. Accordingly, companies developing GenAI technology would face stringent requirements, including technical documentation, compliance with EU copyright laws, and transparent disclosure of training content. Advanced models posing systemic risks will undergo extra scrutiny, necessitating risk assessment, incident reporting, cybersecurity measures, and energy efficiency reporting.

- US President signs executive order regulating AI: In October, President Joe Biden signed an executive order on AI that establishes standards for security and privacy protections and requires developers to safety-test new models. This requires AI tool developers to submit test results on their new models to the government before releasing them to the public. The order also includes the development of standards for watermarking AI-generated content.

- China proposes controls on training data and models to build GenAI services: China is reportedly planning stricter controls on the use of GenAI services in the country to address security concerns and has issued draft guidance on the security of training data and the implementation of LLMs. The draft guidance suggests that authorized data labelers and reviewers should process AI training data and that developers should base their LLMs on foundational models filed with authorities. It also proposes a blacklist system to block training data with illegal or harmful content.

- Germany, France, and Italy forge consensus on future AI regulation: Germany, France, and Italy have united to establish regulations for AI, emphasizing the regulation of AI applications over the technology itself. They endorse mandatory self-regulation via codes of conduct for foundation models and reject untested norms. The proposed rules involve creating model cards to detail AI model functionalities, capabilities, and limitations.

- Bill on training data for AI models introduced by two US lawmakers: In December, two lawmakers introduced an AI Foundation Model Transparency Act, proposing strict transparency requirements for developers of foundational AI models. This bill mandates the disclosure of training data sources, limitations, alignment with National Institute of Standards and Technology standards, and efforts to prevent dissemination of inaccurate information. Referencing copyright-related lawsuits against AI companies, the bill emphasizes increasing concerns about biased or misleading data from the public’s use of AI.

- Beijing court rules AI-generated content can be copyrighted: The Beijing Internet Court issued a ruling recognizing copyright for an AI-generated image in China. The decision considered a picture produced by Stability AI's AI software as an artwork protected by copyright laws due to the intellectual input of a human creator. This contradicts with a previous ruling by the Washington, DC Federal Court that artwork generated by AI cannot receive the same copyright protections as human-created art.

Stages of regulations in major countries/jurisdictions as of Q4 2023

Source: Compiled by SPEEDA Edge based on various sources

Other notable industry updates

- Bletchley Declaration on AI Safety brings together 28 nations in a multilateral agreement to address potential AI risks: A coalition of 28 nations, including China and the US, have acknowledged the importance of addressing potential risks from advanced AI technologies, marking the first multilateral agreement of its kind. The declaration, published by the UK, emphasizes the urgent need for safe and responsible development and deployment of AI for the global community's benefit. The agreement highlights the risks associated with intentional misuse and unintended control issues related to frontier AI, including cybersecurity threats, biotechnology concerns, and the spread of disinformation. The declaration also underscores potential harms from AI models, such as biases and privacy issues, urging international cooperation to address these challenges.

- IBM and Meta launch AI Alliance with 50+ members to support open, safe, and responsible AI: IBM and Meta have jointly launched an AI Alliance, bringing together over 50 global partners from various sectors, including AMD, CERN, Intel, and Oracle, and academic institutions like Cornell University and the University of Tokyo. The aim is to support open innovation and science in AI, fostering a collaborative community to accelerate responsible innovation while emphasizing trust, safety, security, diversity, and economic competitiveness. It focuses on six key areas, including the development of benchmarks, open foundation models, AI hardware accelerators, global AI skills building, educational resources, and initiatives for open AI development.

- G7 reaches agreement on AI code of conduct: G7 leaders have reached an agreement on International Guiding Principles for AI and a voluntary Code of Conduct for AI Developers under the Hiroshima AI Process. The 11 guiding principles provide guidance for AI systems, particularly foundation models and GenAI, focusing on safety and trustworthiness, including risk mitigation, responsible information sharing, incident reporting, and a labeling system. These principles and the voluntary Code of Conduct complement the legally binding rules being finalized under the EU AI Act.

- Frontier Model Forum appoints new director; secures USD 10 million to advance AI governance: Frontier Model Forum, an industry body founded by Anthropic, Google, Microsoft, and OpenAI to promote the safe and responsible development of LLMs, appointed Chris Meserole as its first executive director. The forum also announced the creation of a USD 10 million AI Safety Fund to support independent researchers globally, emphasizing the safe evaluation and development of AI models.

Funding: Foundation Models leads in dollar terms, with GenAI Applications players raising the most rounds

- During Q4 2023, companies in the GenAI space raised USD 3.1 billion in total. The Foundation Models segment attracted the most funding in dollar terms at USD 2 billion, despite the GenAI Applications segment leading in the number of funding rounds (40).

Foundation Models

Analyst take: Key players like OpenAI and Anthropic in the Foundation Models space are actively looking to solidify their positions, evident by their recent efforts to secure additional funding. For instance, OpenAI is reportedly seeking funding that could potentially value the company at over USD 100 billion. Meanwhile, Anthropic set a significant milestone by raising funds five times in a year from tech giants like Amazon and Google, marking itself as the first company in the GenAI space to achieve this feat. Interestingly, newcomers such as Aleph Alpha, 01.AI, and Mistral AI are making a notable impact by injecting healthy competition into the market, securing substantial amounts of funding.

- The Foundation Models space maintained funding stability as 11 players (11 rounds) raised USD 2.0 billion, almost in line (+0.5% vs. Q3 2023) with the previous quarter.

- The LLM segment dominated, with USD 1.4 billion (73.2%) in funding raised across seven (63.6%) funding rounds, with an average deal value of USD 205 million. However, the fine-tuned language models segment marginally exceeded the average deal value, with USD 213 million (even though only USD 426 million was raised over two funding rounds).

- Notably, Google’s investment of USD 500 million in Anthropic (with a commitment to invest an additional USD 1.5 billion), German LLM developer Aleph Alpha’s USD 500 million round, and Mistral AI’s USD 415 million round contributed over 70% of total funds raised during the quarter. Anthropic was also reportedly in discussions to secure USD 750 million in funding, purportedly led by Menlo Ventures, which could value the company as high as USD 18.0 billion.

- Chinese LLM developer 01.AI raised an undisclosed amount in funding, achieving unicorn status in November. In December, it announced that it was seeking USD 200 million in funding to develop open-source AI models. Speculation arose around Thrive Capital purportedly spearheading OpenAI’s tender offer to acquire employee shares, a move that could value the company beyond USD 80 billion. Moreover, in December, it was reported that the company was in pursuit of a new funding round at a valuation of or exceeding USD 100 billion.

- Early-stage funding was the most common form of funding during Q4 2023, accounting for 64.5% of the funds raised and 45.5% of the funding rounds. The seed, growth, and other funding categories reported two funding rounds each.

GenAI Infrastructure

Analyst take: While overall funding in the infrastructure space declined compared with the previous quarter, the hardware infrastructure sector thrived, with an increase of 41% from the previous quarter. This segment also marked the highest count of funding rounds reported in a quarter since 2021. In response to the rising demand for AI chips with substantial computational capabilities, companies like Lightmatter are entering the domain, highlighted by the significant funds raised within the quarter.

- In Q4 2023, 25 disruptors managed to raise USD 550 million in 25 funding rounds. This funding was a 50.2% decrease compared with the previous quarter, even though the number of funding rounds rose (from 17 to 25). It is worth noting that, in Q3 2023, a funding round by Databricks made up 61.9% of total funding.

- The hardware infrastructure segment took the lead both in terms of total funding, contributing 43.9% and accounting for 28.0% of total funding rounds. Even though the largest reported funding during the quarter was by Lightmatter, securing USD 155 million, in this segment, the average deal value was at USD 35 million. The data storage and retrieval segment recorded the highest deal value at USD 41 million (just three funding rounds securing USD 124 million).

- Despite 17 seed rounds being recorded during the quarter (accounting for 68.0% of the total number of rounds), the two growth rounds recorded (Lighmatter’s USD 155 million and VAST Data’s USD 118 million) accounted for the highest funding raised during the quarter (49.6% of total funding). Notably, 15 of the 17 seed rounds were less than USD 10 million in value.

GenAI Applications

Analyst take: According to a recent US survey, two-thirds of companies have made GenAI tools available to the workforce, with the aim of improving productivity. This move seems to correlate with the increased funding observed among companies in the business process improvement segment, which contributed almost half of the funds raised within the GenAI Applications space during the quarter. Notably, in the business process improvement segment, this quarter alone had equal funding rounds to those of the cumulative funding rounds within the first nine months of 2023.

- During Q4 2023, 40 disruptors raised USD 577 million across 40 rounds in disclosed funding, an increase of 67.3% compared with the previous quarter. The business process improvement segment attracted the bulk of funding (47.9% of total funding), while the conversational content segment accounted for 24.8% of the raised funds. Notably, within this segment, chatbot developer xAI secured USD 135 million, which was the highest funding secured by a disruptor within the quarter.

- The business process improvement segment led in terms of the number of funding rounds (17), with an average deal value of USD 16 million. However, the lead in terms of average deal value was held by the conversational content segment (USD 48 million).

- Seed funding was the most common form of funding during Q4 2023 (65.0% of all funding rounds). However, early-stage funding dominated in dollar terms, contributing 47.4% of total funds raised. Notably, no growth-stage funding rounds were recorded.

- 26 startups raised seed funding during the quarter, dominated by xAI's USD 135 million round. Among the notable rounds were Rhythms, an enterprise productivity startup, securing USD 26 million, and Eve, a legal solutions provider, securing USD 14 million. Interestingly, all remaining seed rounds were less than USD 10 million in value.

- 11 startups raised early-stage funding, led by legal solutions provider Harvey with USD 80 million and task automation platform Essential AI’s USD 56.5 million.

Repeat funding rounds during 2023

Analyst take: Repeat rounds, such as in the case of Anthropic, which reported five funding rounds in 2023, indicate sustained investor interest and a push to strengthen expertise and product deployment in GenAI.

- Anthropic was the only company to record five funding rounds during the period (USD 2.6 billion), while Typeface (USD 165 million), Cranium (USD 37 million), MindsDB (USD 47 million), and Tavus (USD 30 million) reported three funding rounds each.

- 28 companies reported two funding rounds, while 141 companies had only one funding round during 2023, with the majority being in the GenAI Applications space (91 companies), followed by GenAI Infrastructure (43) and Foundation Models (seven).

Repeat funding rounds during 2023

Notable funding rounds and investors

- The top 10 funding rounds for Q4 2023 had a combined value of ~USD 2.4 billion, accounting for more than 75% of total funds raised within the quarter. Notably, the top four rounds were dominated by players in the Foundation Models space, while GenAI Infrastructure and GenAI Applications companies secured three rounds each. Notable investors of these rounds were Google, Bosch, SAP, Hewlett Packard, NVIDIA, and Salesforce.

Please refer Appendix 1 for the list of companies that raised external funding in Q4 for the first time.

Product updates: New features, model enhancements, and increasing processing capabilities take center stage

Foundation Models

Analyst take: Several disruptors, including OpenAI, Anthropic, and Inflection AI, alongside established players like Google, unveiled the next iterations of their existing models, showcasing advanced features and functionalities. Another notable update during the quarter was the launch of foundation models that can run on devices. In this regard, Stability AI launched two new enhanced models, StableLM Zephyr 3B and Stable LM 3B, targeting portable devices. Samsung too launched a model that can be applied on device. GenAI running directly on devices has been identified as crucial for scalability, privacy, and optimal performance.

- We tracked 32 product updates during Q4 2023 across 12 disruptors (19 product updates) and 10 incumbents (13 product updates).

- The majority of new models introduced during the quarter were bilingual or non-English models, including 01.AI’s open-source model Yi-34B (Chinese and English); Ola’s Krutrim, a family of LLMs trained in a number of different Indian languages; and Sarvam AI’s open-source Hindi AI model. In addition, Perplexity AI released a new LLM with web search data, while HOPPR introduced a foundation model for medical imaging.

- Several disruptors introduced the next generation of their existing models, featuring advanced capabilities: OpenAI unveiled a more powerful and affordable “GPT-4 Turbo” model; Anthropic released the Claude 2.1 update with enhanced context window and accuracy; Inflection AI introduced Inflection-2 with an improved knowledge base, refined reasoning, and fine-tuned text style adaptation; and Core42 introduced Jais 30B, the latest version of its open-source Arabic LLM. Notably, Stability AI launched two new enhanced models, StableLM Zephyr 3B and Stable LM 3B, targeting portable devices. The company also expanded into video generation by launching the Stable Video Diffusion model.

- Similarly, incumbents launched several new models and upgraded existing models, including Google’s Gemini, which it claimed to be the largest and most advanced AI model to date, and Imagen 2 (upgrade to Imagen) with text and logo generation; Amazon’s Titan Image Generator; Microsoft’s Phi-2 AI model; and Adobe’s image generation models.

- Several non-US companies also launched new models: Alibaba Cloud introduced three new LLMs—Qwen-72B, Qwen-1.8B, and Qwen-Audio—and upgraded its LLM Tongyi Qianwen 2.0; NTT launched its Japanese LLM tsuzumi; Samsung introduced “Samsung Gauss,” which can be applied on device; Vivo announced an open-source BlueLM model and BlueKit large model development kit; KT Corp introduced Mi:dm LLM; and Baidu upgraded Ernie 4.0 with enhanced capabilities.

GenAI Infrastructure

Analyst take: The highlight of the infrastructure space this quarter was the launch of new AI chips with advanced capabilities. While the space is inherently dominated by incumbents, interestingly, several disruptors, including Preferred Networks and Kinara, entered the space. Meanwhile, Google unveiled an AI model trained on custom silicon chips, while Microsoft launched its in-house designed AI chips. Notably, OpenAI was looking to create its own AI chips that would place it in a select league of major tech entities. The decision for OpenAI to proceed with developing its own chips remains uncertain, and such a move would signify a significant strategic endeavor and require substantial investment.

- We tracked 56 product updates in Q4 2023 among 22 disruptors (23 product updates) and 14 incumbents (33 product updates).

- This quarter, several players launched AI chips that are energy-efficient, with faster processing, and improved memory capacity, specifically designed for training AI models. This was led by incumbents, such as the following:

- Amazon’s Trainium2 AI chip the Graviton4 processor

- AMD’s MI300X accelerator and the Instinct M1300A accelerated processing unit

- Intel’s Gaudi3 and Core Ultra 9 185H (both expected to be launched in 2024)

- MediaTek’s Dimensity 8300 and Dimensity 9300 for on-device processing

- Micron Technology’s 128 GB DDR5 RDIMM

- Qualcomm’s Snapdragon 8 Gen 3, a new mobile System-on-Chip for GenAI on Android smartphones

- Taiwan Semiconductor Manufacturing Company’s A14

- Disruptors too introduced new chips, posing a challenge to incumbents' dominance in the space; Kinara launched Ara-2 Edge AI processor, designed for running GenAI models on edge servers and laptops, Preferred Networks announced the completion of the design of its second-generation AI chip, and Sapeon Korea unveiled a new AI chip (X330) for data centers.

- Meanwhile, Microsoft launched its in-house designed AI chips, the Azure Maia 100 AI Accelerator and the Azure Cobalt 100 CPU, in response to the scarcity of GPUs for AI model development. Google also reported that its latest model Gemini was trained on its own custom silicon chips. Additionally, unconfirmed reports emerged, stating that OpenAI was looking to develop its own AI chips to reduce dependency on third-party chip providers like NVIDIA and AMD.

- With increasing interest in custom foundation models, several disruptors, including Datasaur, FedML, Hugging Face, and Outerbounds, launched new products and tools to enable enterprises to develop custom models. Adding to this, disruptors like Cohere (introduced build-your-own connectors to securely retrieve data from company data sources and a new iteration of its embedding model Embed V3 to improve efficiency of document-to-query matching) as well as incumbents like Microsoft and NVIDIA launched solutions to enable retrieval-augmented generation (RAG). Implementing RAG allows companies to elevate a model's capabilities by feeding company-specific new data into the model, enabling it to access the latest and most pertinent information for better model performance.

- Similarly, a group of disruptors—Kyndryl, Landing AI, Lightning AI, OctoML, Snowflake, and Weav—launched new tools to support the development of GenAI applications. In addition, Incumbents Google and NVIDIA introduced their own solutions, aimed at simplifying application development.

- Another area of interest was LLM evaluation tools, which focus on evaluating the quality of LLM responses for accuracy and relevance. Arize AI, DeepChecks, Giskard, Lumenova AI, and Scale AI were among the disruptors that launched such tools. Notably, Amazon (through AWS) and IBM (through watsonx) launched similar solutions, enabling companies to implement safeguards for models.

- Other notable product updates in the infrastructure space during the quarter included Google Cloud launching Vertex AI Search to assist enterprises in discovering information efficiently in GenAI product development; data security and management disruptor Cohesity launching Cohesity Turing secure data indexing, AI-driven analytics, and RAG; Hyper Intelligence launching Hyper.Train, a quantum-inspired tool aimed at optimizing LLMs.

GenAI Applications

Analyst take: The space saw two notable OpenAI competitors (for ChatGPT) emerge: xAI’s Grok and Reka’s Yasa-1. In response to increasing competition, OpenAI has stayed a step ahead by introducing additional multimodal features including voice capabilities. The company also introduced updates to customize chatbots and relaunched its web browsing capabilities. Incumbents including Google and Microsoft also effectively responded to this by introducing more features to their chatbots and expanding access to mobile devices via the launch of mobile apps.

- We tracked 61 product updates during Q4 2023 across 16 disruptors (28 product updates) and nine incumbents (33 product updates).

- OpenAI recorded several updates to its chatbots, including the following:

- The formal launch of the web browsing feature for Plus and Enterprise members. The company initially introduced web browsing to ChatGPT in March 2023; however, it was temporarily withdrawn after issues with displaying paywalled content

- Extending its voice functionality to free users

- A new beta feature for Plus members to be able to upload and work with files

- An update that allowed users to use all premium features at the same time, including Browse with Bing, Advanced Data Analysis, Plugins, and DALL-E 3

- Announcing a new platform allowing users to create custom versions of their chatbot, named GPTs, to be available through the GPT Store (this feature was not yet to be launched as of the end of Q4 2023)

- Two notable companies emerged with new chatbots during the quarter, posing as formidable competitors to OpenAI. One of them is “Grok,” developed by Elon Musk’s xAI. The chatbot was initially made available to premium X (formerly Twitter) users in the US and later expanded to 45+ other countries. Reka also launched Yasa-1, a multimodal AI assistant that understands text, images, short videos, and audio snippets and can be customized on private datasets.

- Image-generation platform Midjourney also announced several updates, including a redesigned website in the beta phase for searching, browsing, and viewing images; an Alpha web platform for AI image generation; “Style Tuner” for customized image generation; an upscaling feature for enlarged images; and a mobile app to generate images.

- Several disruptors introduced new features to enhance their existing products during the quarter, including the following:

- Anthropic releasing Claude for Sheets, a plugin designed to enhance Google's spreadsheet software

- Chatbot company Character.ai’s Group Chat feature, allowing users to create group chats with AI characters and even mix them with humans for social connections

- Multimodal search engine You.com’s launch of YOU API to offer real-time access to internet data

- Cresta’s launch of new enhancements to its AI modules to facilitate data-driven decision-making and customer relationship management

- ElevenLabs’ voice translation tool for automatic translation of speech into different languages

- Regie.ai’s Email Analyzer feature to improve quality of sales emails and a tool to prevent hallucinations in sales content generation

- Google and Microsoft dominated, collectively representing nearly 65% of the updates disclosed by incumbents.

- Google launched several updates for its chatbot, Bard, headlined by the introduction of Gemini Pro, a new language model, enhancing response quality and user intent comprehension. Other updates to Bard include a feature to answer questions about YouTube videos, real-time responses, and a feature for better email summarization and image sharing. The company also expanded accessibility of the chatbot further by launching Assistant with Bard, a new voice assistant that combines Bard's capabilities with personalized help, and granting teenagers global access to Bard. Google also released a set of GenAI tools named Product Studio for advertisers in the US and added GenAI capabilities to ad campaign platform Performance Max.

- Following its renaming from Bing Chat to Copilot in November, Microsoft made substantial improvements to its chatbot by integrating OpenAI's latest models, such as GPT-4 Turbo and an updated DALL-E 3 model, enabling better query understanding and more effective responses. Microsoft also expanded Copilot with new offerings, Copilot for Azure, Copilot for Service, and Copilot Studio. In parallel to Google's efforts, Microsoft rolled out a dedicated Copilot app for Android and iOS. It also expanded accessibility by bringing Copilot to Windows 10 and Windows 11 updates.

Partnerships: Collaborations aimed to improve product features and availability

Foundation Models

Analyst take: As models advance, companies are increasingly seeking larger datasets for training purposes. Despite privacy concerns, OpenAI persisted in partnering with news companies for model training. Concurrently, various disruptors like Assembly AI, Cohere, and Mistral AI joined forces with Cloud providers to make their models more accessible. This expansion broadens model choices for building and scaling enterprise-ready GenAI on the cloud, simplifying the development process while ensuring privacy and security. Notably, both disruptors and established players showed a keen interest in on-premise deployment, as demonstrated by Hugging Face and Meta's collaboration with Dell.

- We noted 42 partnerships in the Foundation Models space during Q4 2023, across 10 disruptors (32 partnerships) and seven incumbents (10 partnerships). The disruptor partnerships were predominantly (62.5%) in the form of customer partnerships:

- OpenAI: 14 customer partnerships, with several notable customers including Microsoft (for Microsoft Paint and Be My Eyes), Shutterstock, LinkedIn, the UK Treasury, and Humane

- Hippocratic AI: five companies (OhioHealth, Roper St. Francis Healthcare, Evernow, Guidehealth, and HarmonyCares) partnered to obtain early access to Hippocratic AI's patient-facing nondiagnostic LMs for healthcare

- AI71: TAMM, representing Abu Dhabi's Department of Government Enablement (DGE) partnered to use AI71’s Falcon series of LLMs

- In product collaborations, AI21 Labs partnered with infrastructure providers Invisible Technologies and Snowflake, integrating their solutions to refine AI21 models for tailored datasets catering to specific use cases. Meanwhile, OpenAI extended its collaboration with news publishers by partnering with Axel Springer, leveraging their content to further train its AI models. Anthropic also partnered with Google to use custom AI chip v5e to train GenAI models.

- Assembly AI, Cohere, and Mistral AI partnered with Amazon to improve the accessibility of their models by making them available in cloud platforms (AWS Marketplace, Amazon Bedrock, and Amazon SageMaker JumpStart). Mistral AI also partnered with Google to make its 7B open LLM model available in Google's Vertex AI Model Garden, simplifying deployment across various cloud platforms for easier testing and launching of AI applications. OpenAI’s GPT-4 Turbo model was also made available on the Microsoft Azure OpenAI Service in public preview. OpenAI also entered a partnership with UAE-based G42 to deliver advanced AI solutions in the UAE and regional markets, leveraging OpenAI's models in sectors such as finance, energy, healthcare, and public services. Incumbent LG also launched an AI image-to-text captioning solution on AWS, using EXAONE, a 300-billion-parameter multimodal model.

- Both Hugging Face and Imbue partnered with Dell to facilitate on-premise deployment of GenAI models and to acquire servers for training models, respectively. Similarly, incumbent Meta partnered with Dell to offer open-source LLaMA 2 LLM on Dell Validated Design for GenAI hardware and on-premises AI solutions, enabling users to deploy the model on their own premises.

- IBM initiated collaborative product ventures with multiple companies to leverage their models, notably including the following:

- NASA: To address climate-related challenges across regions like the UAE, Kenya, and the UK, by leveraging a fine-tuned geospatial model

- Boehringer Ingelheim: To expedite antibody discovery through in-silico methods by creating a digital ecosystem, leveraging IBM's AI models

- FuelCell Energy: To enhance its technology by using foundation models to support the transition to cleaner renewable energy sources by creating data-based digital replicas of fuel cells

GenAI Infrastructure

Analyst take: Most partnerships by established players were with cloud infrastructure providers such as Microsoft Azure, Google Cloud, and Amazon Bedrock to leverage their cloud-based infrastructure and the foundation models available on them to develop GenAI solutions.

- In the GenAI infrastructure space, we tracked 60 partnerships by six incumbents (53) and 10 disruptors (7) collectively.

- Microsoft forged partnerships with industry giants like Schneider Electric and Google partnered with McDonald's and Moody's, while Amazon’s notable customers included Tata Consultancy Services, WhyLabs, BMW, Booking.com, and Cathay Pacific Airways. The main purpose of these partnerships is for these companies to develop their own GenAI solutions. IBM entered similar partnerships (including with the Ministry of Electronics and Information Technology of India), while several companies partnered with NVIDIA (e.g., Wipro, Dropbox, and Amdocs) to use its computing and infrastructure solutions.

- Two sales partnerships were reported: 1) data training and validating platform Scale AI and Microsoft to offer Scale AI’s Enterprise GenAI Platform (EGP) on Microsoft Azure and 2) Oracle and NVIDIA to add NVIDIA AI capabilities to Oracle’s Cloud Marketplace.

- Amazon entered product collaborations to offer integrated infrastructure solutions with C3 AI (to provide advanced GenAI solutions for enterprises), DataStax (to jointly develop, market, and sell GenAI products), Privacera (to add governance solutions to secure foundation models), Qlik, SnapLogic (to offer turnkey data management and integration solutions), New Relic (to offer AWS customers with enhanced visibility and insights across their AI stack), Gretel (to offer access to synthetic data generation models and tools), and IBM (to enhance GenAI capabilities for mutual clients).

- Both IBM and Google partnered with cloud and virtualization services provider VMware to deliver their infrastructure solutions on the VMware platform for on-premise deployments.

GenAI Applications

Analyst take: Most partnerships among established players primarily involved customers, suggesting the rising adoption of GenAI solutions. Meanwhile, disruptors concentrated on broadening solution accessibility through partnerships with distributors and cloud service providers. Additionally, collaborations between incumbents and disruptors highlighted the recognized value of joint efforts in enhancing product offerings within the space.

- We counted 26 partnerships in the GenAI Applications space during Q4 2023, across eight disruptors (nine partnerships) and five incumbents (17 partnerships). This excludes disruptor customer partnerships.

- Among the disruptors, music creation platform Boomy and customer support automation platform Forethought entered partnerships with Warner Music Group and Amazon (AWS marketplace), respectively, to expand the availability of their products. Boomy also partnered with Beatdapp to verify the authenticity of its streams across digital streaming platforms. Elon Musk's xAI also improved product accessibility by integrating its chatbot into X (formerly Twitter) platform.

- Chatbot developer Got It AI partnered with NVIDIA to integrate ELMAR platform with NVIDIA AI Enterprise for on-premise applications, while content creation platform Regie.ai enhanced its platform by integrating with Salesforce, improving reporting and persona-based message generation for sales teams.

- Several disruptors partnered with incumbents—video creation platform Runway and Getty Images partnered to develop a model for generating video content, named Runway - Getty Images Model (RGM), and Xbox, Microsoft's video gaming brand, partnered with character developer platform Inworld AI to develop AI dialogue and narrative tools for video games. This effort was part of Microsoft's vision to provide creators with advanced tools to push the boundaries of game development and player experiences.

- The majority of the partnerships (50%) recorded by incumbents were with customers. For example, five customers including the NatWest Group partnered with Amazon to use the Amazon Connect platform, while six customers including NTT Data and the US Government partnered with Microsoft to deploy Microsoft 365 Copilot solutions. Similarly, Omnicom partnered with Getty Images to obtain early access to Getty’s GenAI tool to generate commercial images, and Red Hat released Ansible Lightspeed in collaboration with IBM's Watsonx Code Assistant.

- Product collaborations were reported by Amazon and Microsoft partnering with GenAI infrastructure providers MongoDB (to optimize Amazon CodeWhisperer for enhanced application development) and Oracle (to enhance Bing's AI search with cloud infrastructure), respectively. Microsoft also partnered with music creator app Suno to bring a music creation feature to Copilot.

Incumbent partnerships in the GenAI ecosystem Q4 2023

Analyst take: Established industry leaders partnered with GenAI startups for many reasons, including: 1) to extend their product accessibility across cloud marketplaces, 2) to enhance and refine existing solutions, and 3) to collaborate on the development and delivery of integrated technologies.

- During Q4 2023, several incumbents invested in startups, the most prominent being Google’s investment in Anthropic. Intel was a lead investor in both AI21 labs’ USD 208 million round (through Intel Capital) and Stability AI’s USD 50 million round. Chinese tech giants like Alibaba invested in the Chinese startup ecosystem, leading 01.AI’s undisclosed round. Notably, several incumbents including AMD, Google, and NVIDIA participated in task automation platform Essential AI’s USD 56.5 million round.

- In terms of partnerships, several incumbents forged partnerships with disruptors; for example, Amazon partnered with startups in all three segments, including a partnership with infrastructure provider MongoDB to optimize Amazon CodeWhisperer, models developer Mistral AI to introduce Mistral 7B models in Amazon SageMaker JumpStart, and customer support automation solutions provider Forethought to make its offerings available on AWS Marketplace.

Incumbent partnerships in the GenAI ecosystem (Q4 2023)

Please refer Appendix 2 for the full list of partnerships.

M&A: Infrastructure disruptors dominate

Analyst take: In Q4 2023, the GenAI space experienced a significant improvement in M&A activities (four compared with two last quarter). The highlight was an incumbent (Adobe) acquiring a disruptor (Rephrase) in the GenAI Applications space. All three other M&A activities were reported from the GenAI Infrastructure space, with Databricks recording its second large acquisition in four months (following MosaicML).

- Adobe acquired text-to-video technology company Rephrase for an undisclosed sum. Rephrase Studio, the flagship product of Rephrase, enables a user-friendly environment for creating professional videos. With the acquisition of Rephrase, Adobe aimed to improve its Creative Cloud products, extending its capabilities in GenAI videos. Adobe’s suite will be enhanced with Rephrase's technology in converting text to video.

- Docker, a containerization platform, acquired AtomicJar, a startup that offers a container testing platform. Docker aims to enhance its comprehensive set of build, test, and deploy services for developers by integrating AtomicJar's testing capabilities to strengthen its position in the market.

- Data infrastructure and data analytics solutions provider Databricks agreed to acquire database replication platform Arcion for USD 100 million. Previously, Databricks had invested in Arcion’s USD 13 million Series A funding round in February 2022. Following the acquisition, Databricks plans to integrate Arcion’s technology into its existing platforms.

- Data management and analytics platform Snowflake acquired data clean rooms developer Samooha for an undisclosed sum. The two companies have previously collaborated to build data clean room products. Snowflake reportedly plans to incorporate Samooha’s technology into its own data clean room solutions, expanding existing integrations and enhancing its platform.

Appendices

Appendix 1

Startups that raised external funding for the first time in Q4 2023

Appendix 2

Disruptor partnerships in Q4 2023

Incumbent partnerships in Q4 2023

Contact us

Gain access to all industry hubs, market maps, research tools, and more

Get a demo

By using this site, you agree to allow SPEEDA Edge and our partners to use cookies for analytics and personalization. Visit our privacy policy for more information about our data collection practices.